Yes, although they need the right conditions and access to your phone to do so. While that access is difficult, it’s possible. They don’t even need to be in the same location as you to gain that access.

Hi, I’m Aaron. I’m a cybersecurity professional and researcher. I love learning about different methods of attack and sharing my knowledge with people to help them interact with technology safely.

I’ll explain how someone can hack your Zelle using your phone number. I’ll also outline some steps you can take to keep your Zelle account safe.

Table of Contents

Key Takeaways

- Your Zelle can be hacked with only your phone number if your bank doesn’t partner with Zelle.

- If your bank partners with Zelle, hacking your bank account provides access to Zelle.

- If a hacker has access to your bank account, they can input a new number into Zelle and transfer money to themselves.

- Safe account management practices will keep your account safe.

- You should also be wary of phishing or other scams designed to gain access to your accounts and assets.

How Your Zelle Can Be Hacked With Your Phone Number

Zelle uses your phone number as a method of authentication, a way to prove your identity. If your bank doesn’t partner with Zelle, then a hacker could access your Zelle using your phone number.

They would need access to your phone, however. Zelle sends a code to log in and that code would be sent to the phone number being used to log in.

Hackers can gain access to that information through SIM cloning or SIM spoofing. That typically requires physical access to your phone and SIM card, however. There are scams that allow them to impersonate you to the phone company, but they still need you to provide your SIM number to them.

Hackers Don’t Need Your Phone Number

If your bank is one of the thousands that partners with Zelle, a hacker doesn’t need your phone number. They just need access to your bank account. That may sound difficult, but it can be trivial.

If your bank partners with Zelle, then you must access Zelle from your bank account. Typically, online bank access uses a username and password, not a phone number.

If you reuse passwords between different websites, use simple passwords, and/or don’t have multi-factor authentication enabled, then a hacker may have the information necessary to access your bank account without your knowledge.

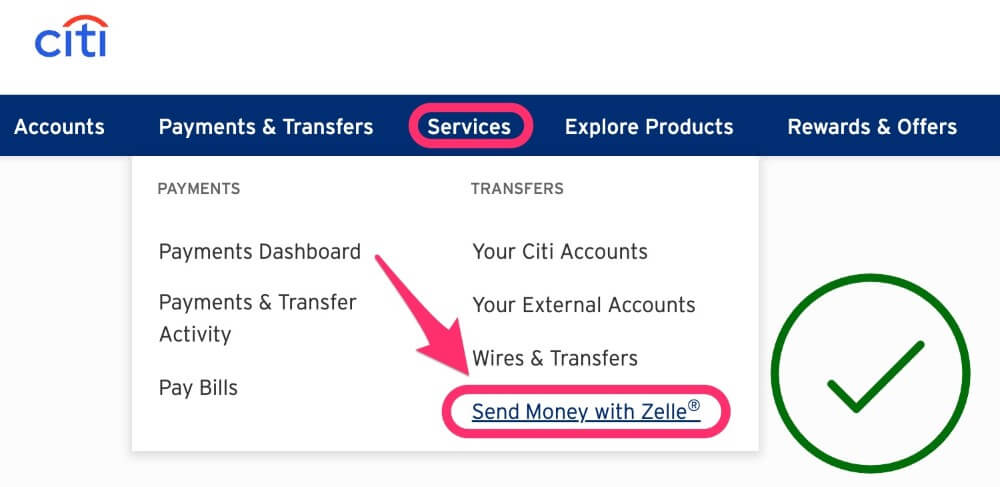

That hacker can then associate a mobile number of their own and use that to send money to an account they’ve created. They can do that entirely without your knowledge or intervention.

How to Protect Yourself

There are a few ways to protect yourself and your bank account from hacking.

1. Don’t Give Out Your Banking Information

This one should seem obvious, but is a prime target for hackers. Don’t give out your banking information unprompted–meaning that you didn’t initiate the transaction.

Only initiate a transaction involving your banking information if you know the recipient is legitimate. Check and double-check that whomever you’re speaking with is the company with which you intend to transact and that company and its products are legitimate.

You should also…

2. Never Reuse Passwords

At least for critical services like email, banking, and other potentially reputationally or financially damaging accounts. If you reuse passwords and one of the places you used the password is hacked, then a hacker may have your username and password.

Once they have that, they can access every service using that username and password combination. Minimizing reuse and the opportunity for theft of your password is critical for keeping sensitive accounts safe.

Think about…

3. Using Complex Passwords and Passphrases

The longer your password and the more difficult to guess, the more secure it is. A difficult-to-guess 11-character password using upper and lower case, numbers, and symbols will take three years to guess in 2023. Add one character to make that 12 and it takes 226 years on average to guess.

What makes a password difficult to guess? Use uncommon words that are not directly related to prior passwords or otherwise easily guessed.

For example, if you like computers Ihaveacomputer!123 is a bad password. 10700Kibmps23090FE@20113 is a better password. I’ll remember it easily because it’s my computer’s processor, keyboard, GPU, and the date I purchased it. It’s also 24 characters, meaning that with current technology, it will take trillions of years to guess.

You can also complexify account access when you…

4. Enable Multi-Factor Authentication

Your bank, phone provider, and other service providers likely allow you to use two-factor or multi-factor authentication (also known as 2FA or MFA). What that does is implements an additional layer of protection above and beyond your username and password.

For example, if you use text 2FA, then upon logging in, you’ll be sent a code over text to enter before accessing your account. Without that code, typically provided via text, a call, email, or an authenticator app, your account can’t be accessed.

That means that in addition to your account information, a hacker needs access to your phone, email, or authenticator. That added complexity makes it tougher to hack you. In turn, that makes you a less appealing target.

Hackers don’t need to guess your password or 2FA code, so…

5. Don’t Fall for Phishing

Your Bank and Zelle won’t ask you for your username, password, or passcode unprompted. Your phone company wouldn’t ask for your SIM number unless you call them to troubleshoot a serious phone issue.

Don’t provide account information, passphrases, SIM numbers, or other codes unless you started the call and you are asking for help. If you receive a call purporting to be from your bank, phone provider, or other service provider and they ask for your account information, you need to hang up and call them back.

If you call your bank, phone provider, or other service provider, call them using publicly available numbers on their official website. They’ll never get upset that you called them back. To the extent it helps them fight fraud, they’ll applaud your efforts.

If you ever feel concerned that a request is illegitimate, don’t engage further and hang up. That’s always an option and can be your best option. Scammers may use high-pressure tactics to extract information from you.

FAQs

Here are some answers to questions related to your Zelle being hacked using your phone number.

Is It Safe to Accept Zelle Payment from Strangers?

Yes. Zelle payment scams typically go beyond just accepting payment. Scammers will ask for reimbursement, typically via you paying the scammer. Don’t do that. If you receive money and are asked for reimbursement, tell the sender to ask their bank to reverse the transaction. You can also ask the same of your bank.

Can Someone Hack Zelle with Just Email?

You can be phished via email. By asking you to provide account or other sensitive information, you may divulge information sufficient to provide access to your Zelle and bank account.

What to Do if I Got Scammed on Zelle?

Call your bank and Zelle immediately at the fraud numbers they provide on their official websites.

Conclusion

While it is possible for your Zelle to be hacked with nothing more than your phone number, it’s not the most common way Zelle can be hacked. If an attacker has access to your bank account, they can hack your Zelle through that. Safe internet and device use is critical to protect you from financial loss.

Have you encountered a Zelle scammer in the wild? Let me know your experience in the comments below!