No. A hacker would need a lot more information to hack your Cash App. If they only have your name, they can tell whether or not you have a Cash App account. Only if they have additional personal, private information could they hack your Cash App account.

I’m Aaron, a cybersecurity professional with two decades of experience managing and securing accounts. Securing your Cash App account is very similar to securing other accounts.

In this article, I’ll explain why your name alone is insufficient to hack a Cash App account. I’ll also highlight what’s needed to hack your Cash App account and what you can do to protect that information.

Table of Contents

Key Takeaways

- Your name is insufficient on its own to hack your Cash App.

- A hacker will need your email address or phone number.

- They’ll also need access to your email account or phone.

- Make sure you engage in safe internet and device use.

What Information is Needed to Log in to Cash App

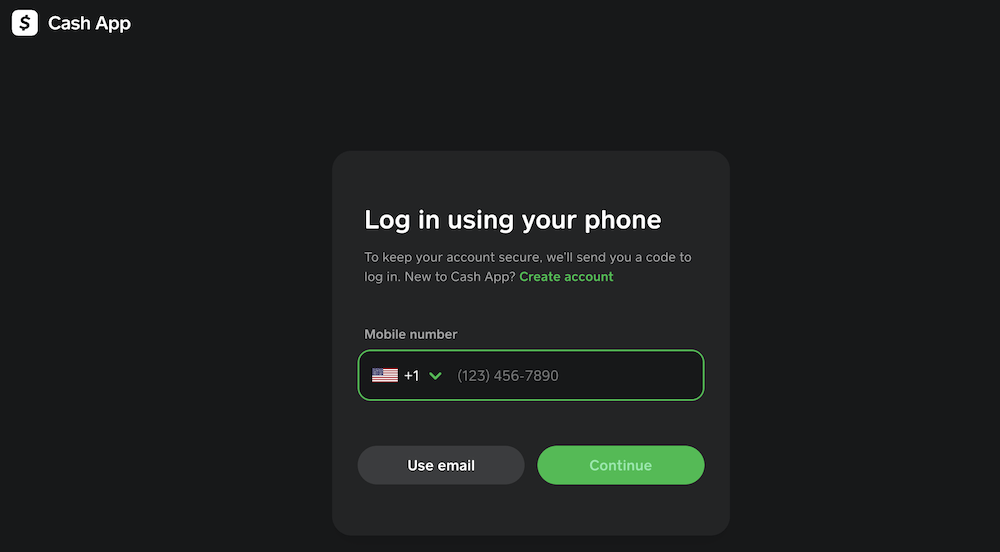

Cash App uses a username to set up and log in to an account. Cash App then sends a passcode to log in to the account to the email address or mobile number used to register the account.

You provide Cash App with your name and other personally identifying information to create a Cash App. Cash App will create a $Cashtag, which represents your account identifier for sending and receiving money.

Neither your name or your $Cashtag are used during the log-in process. So as long as your username isn’t your actual name or $Cashtag, then knowing your name and/or $Cashtag won’t provide a hacker with any relevant login information for your Cash App account.

How Your Cash App Account Can Be Hacked

As outlined in the previous section, two elements are needed to log in to your Cash App account. The first is your username. That can be your email or phone number used to register your Cash App account.

That email address or phone number will also receive your passcode from Cash App to log in. The passcode is the second element needed to log in to your account.

A hacker can access your Cash App account if they have access to your phone or email. To access your phone, a hacker would need to clone your SIM card. That’s a non-trivial process and requires access to both your phone and your phone provider account plus a lot of personal information.

To access your email, a hacker would need your email address and password. If you reuse passwords previously compromised elsewhere, they may have your password. Alternatively, if you used a very simple password for your email, then they may be able to guess your password.

Hackers can also gain access to your passcode through social engineering attacks. One common attack is to pretend to be Cash App and say that they sent you a passcode as a test. If you provide the passcode, you’ll pass the test. In reality, the hacker can use your passcode to log in as you.

How to Protect Yourself

There are a few things you can do to protect yourself.

1. Use a Unique Complex Password or Passphrase to Secure Your Email

Create a unique password for your email account that’s not reused anywhere else. It should be long and use a combination of numbers, upper case and lower case letters, and special characters.

Even better: use a passphrase. Come up with a phrase based on seemingly unrelated items that’s easy for you to remember but not easy to guess.

For example, Ilovebaseball!123 is a bad long password because it’s easy to guess. BasesHotdogsMitJumbotron is much better because those are terms related to baseball but unrelated to each other.

You should also…

2. Use Multi-Factor Authentication

Enable multi-factor authentication for your email account, phone provider account, and other accounts. This ensures that possession of an account name and password is insufficient on their own to access the account.

Multi-factor authentication requires a hacker to have access to another account or device to log-in in addition to the account’s name and password required to initially log-in. It adds significant complexity to logging-in, which dissuades hackers who want easy and quick access.

3. Don’t Let Your Phone Out of Your Sight

SIM spoofing and SIM cloning allow a hacker to gain access to phone account information and text messages. Most SIM spoofing or SIM cloning requires access to the original SIM card. Without that access, hackers can’t easily clone or spoof the SIM card.

Only give your phone to people you trust. If you have to give it to someone you don’t trust for any reason, don’t let the phone leave your sight. Definitely don’t let that person disassemble your phone or otherwise remove the SIM card.

4. Be Wary of Phishing

Don’t engage with emails when you don’t know the sender. If the sender purports to be from an official business, contact the business directly using publicly accessible phone numbers and email addresses to confirm if the communication and request are legitimate.

If your phone company or Cash App asks you for your username and password out of the blue, it’s likely not legitimate. If your phone company asks you for your SIM card number unprompted, it’s likely not legitimate. Where a company actually needs that information, you can contact them independently and validate that need before providing the information directly to them.

FAQs

Here are some answers to questions related to your name being used to hack your Cash App.

Can You Get Scammed If Someone Sends You Money on Cash App?

Yes! This is, unfortunately, a common scam. Someone will send you money on Cash App and then demand it returned via a new payment. By paying them, the scammer can still get their money refunded and double their money. Always refund the money and never initiate a new transaction for repayment.

Can Someone Steal Money From Your Cash App?

Yes. You may be phished and asked to provide personal information, including your Cash App login information. Alternatively, you could be asked to make a payment for something that is illegitimate.

Is Cash App Safe to Receive Money from Strangers?

It’s no less safe than other online financial transactions. Be careful if there are requests that exceed being paid money. For example, someone can ask you to pay some money back which, as identified above, you shouldn’t do.

Conclusion

If a hacker has your name or $Cashtag, it’s unlikely they’ll be able to hack your Cash App. They’ll need access to more information, accounts, and devices like your email address or phone. You can protect yourself by engaging in safe internet usage and behaviors.

Have you encountered a Cash App scammer? What was your experience with them?